About this deal

Before we start, the Full Screen of any application means you don’t see any buttons or address bar on the top. So if you're a basic-rate (20%) taxpayer at the time you come to withdraw the state pension lump sum, you'll be taxed as a basic-rate taxpayer, even if the lump sum you get pushes you into a higher tax bracket. Due to an unfortunate quirk in the tax system, the first lump sum you take from your pension often won't be taxed correctly, meaning that you'll pay more tax than you need to. With this type of pension, the decision about whether to take a lump sum has traditionally been more straightforward.

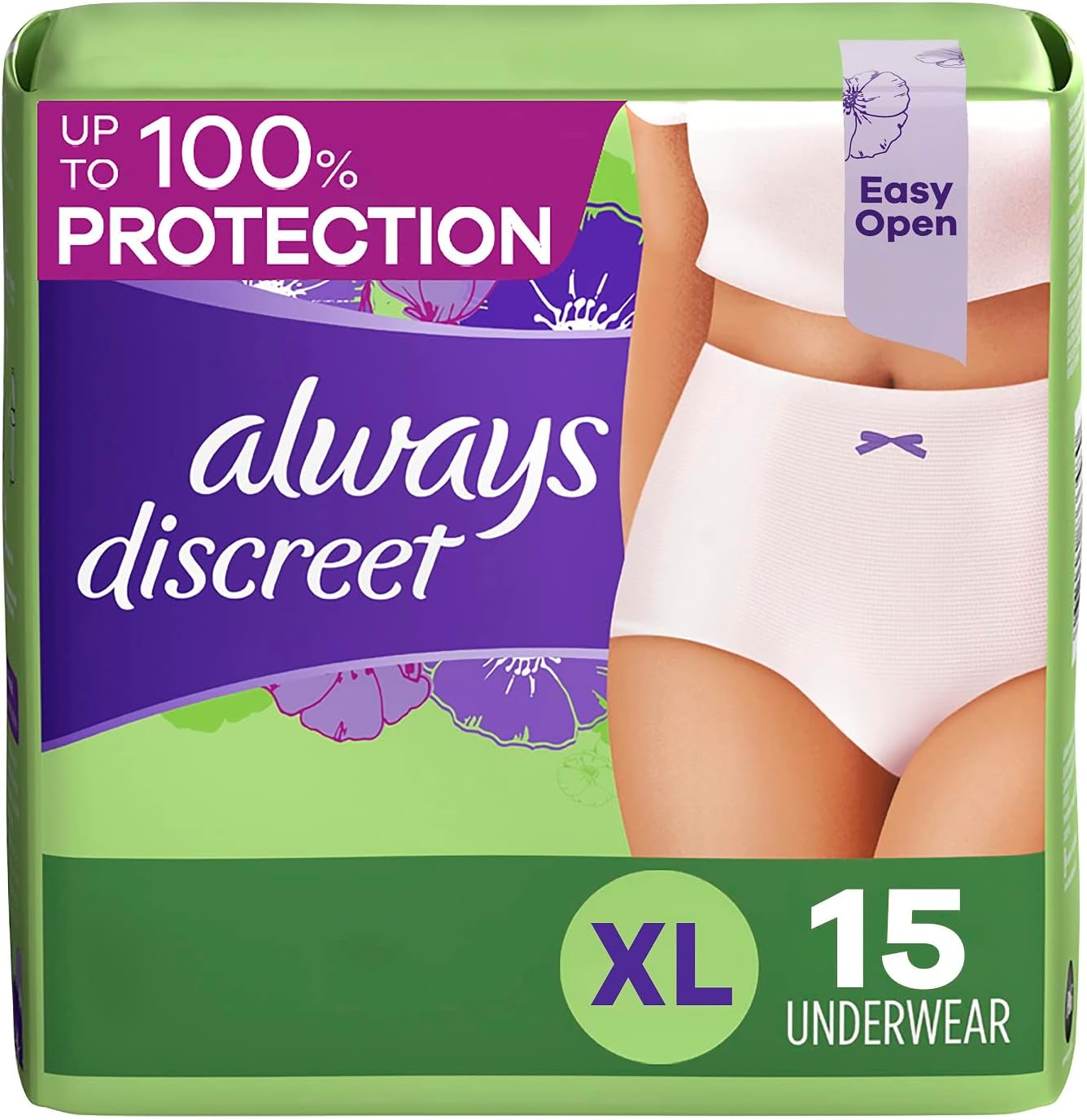

Always Discreet Maximum Protection Underwear

When i first turned it on, it was overclockling my cpu and (i assume because of the weak wraith stealth cooler) temperatures where very high and making a "high-low" temp graphic, high spikes every 3 or 4 seconds. But for your first withdrawal, your pension company will not know your personal tax code, or about any income you have from other sources.The amount you get will be a proportion of your final salary or your career average salary when you come to retire. Airmode can also be enabled to work at all times by always putting it on the same switch such as your arm switch, alternatively you can enable/disable it in air. Therefore, it applies a 'Month 1' tax code to your lump sum, which assumes the amount you've withdrawn is 1/12th of your annual income. Once you cash in (or crystallise) your pension pot, you can take up to 25% tax-free up front and the rest is taxable, see our example, above.

Maxi Pads | Always®

To view the purposes they believe they have legitimate interest for, or to object to this data processing use the vendor list link below. Optimise Media Limited (FRN 313408), for the introduction of HSBC Group, who are authorised and regulated by the Financial Conduct Authority to provide credit brokering activity. This is the rate at which you give up the annual pension you will have in retirement in exchange for getting some cash up front. I haven't installed it, so unless it is installed by default with my drivers or something it shouldn't be on.

I have read that Ryzen, when monitored, likes to clock up to max as if an application was demanding its maximum. If you take a lump sum from your state pension, tax should be deducted from it by the Department for Work and Pensions. IMPORTANT: The asi is only compatible with this mod, the asi is incompatible with other traffic scripts.

What are multi-drop deliveries and who are they for? | Gophr What are multi-drop deliveries and who are they for? | Gophr

We say local maximum (or minimum) when there may be higher (or lower) points elsewhere but not nearby. I already tried gaming, and it its perfectly normal, wont overheat and is delivering its performance very well. And it’s much better for the environment, as couriers are covering fewer miles on routes mapped out by our cutting edge technology.Spreading withdrawals over a number of years can minimise your tax bill and mean that your tax-free entitlement is spread over several years. I recently bought a whole new computer, with the new Ryzen 5 3600 and a "arsenal gaming" B450 motherboard, that already came with a updated BIOS to use the processor. com Ltd for the introduction of non-investment motor, home, travel and pet insurance products (FRN 610689). This means you could lose some or all of your personal tax-free allowance and a big chunk of your lump sum could be taxed at the highest 45% rate, even if your total income for the year is much lower.

Great Deal

Great Deal